FactCheck.org : Health Care Law and W-2 Forms

May 26, 2010 . Q: Does the new health care law require workers to pay income tax on . insurance) will be considered income and added to your gross pay.

http://www.factcheck.org/2010/05/health-care-law-and-w-2-forms/

Paying Income Tax on Your Health Benefits?

Jun 2, 2010 . Will you have to pay taxes on your health benefits? . is being added to your W-2 form, but it's not going to be added to your gross income.

http://www.fivecentnickel.com/2010/06/02/paying-income-tax-on-your-health-benefits/Medical Insurance Contributions to be Recorded on W-2 Forms and ...

Jul 17, 2010 . This amount will not be taxable nor added to the employee's gross income. In an April 5, 2010 article called "Health Care Reform: 13 Tax .

http://www.truthorfiction.com/rumors/h/HR-3590-W2-TAX.htmUW-Madison Payroll and Benefits Services :: Imputed Income

Dec 9, 2011 . Imputed Income and Health Insurance Benefits . Adding a non-tax dependent to your health insurance coverage may have tax consequences.

http://www.bussvc.wisc.edu/ecbs/imputed-income.html

health insurance aetna trouble:

Section 143-121 Missouri adjusted gross income.

Aug 28, 2011 . The Missouri adjusted gross income of a resident individual shall be the . There shall be added to the taxpayer's federal adjusted gross income: . for any insurance policy primarily providing health care coverage for the .

http://www.moga.mo.gov/statutes/c100-199/1430000121.htm

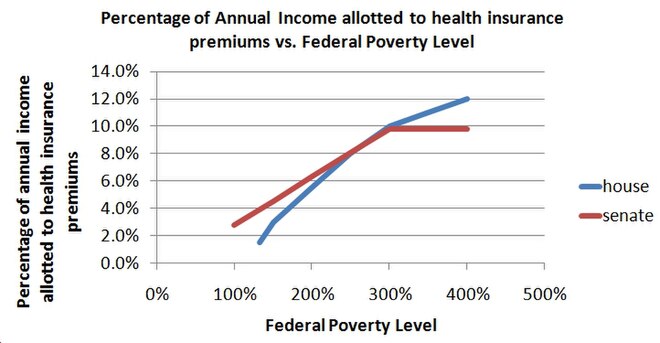

Tax Provisions in the Health Care Reform Law

Mar 30, 2010 . This term is defined in the newly added section 5000A of the Internal . Tax credits to help purchase health insurance for lower-income people.

http://taxes.about.com/b/2010/03/30/tax-provisions-in-the-health-care-reform-law.htm

Previous in TP Health

Previous in TP Health

Health Care Reform: 13 Tax Changes on the Way - Kiplinger

Oct 8, 2010 . The new health care reform law is chock-full of new taxes and tax increases . The latest: Income inequality, David Foster Wallace does taxes, and the staff's . premiums for 30 years is 40 percent tax added to my premiums!

http://www.kiplinger.com/businessresource/forecast/archive/health-care-reform-tax-hikes-on-the-way.html